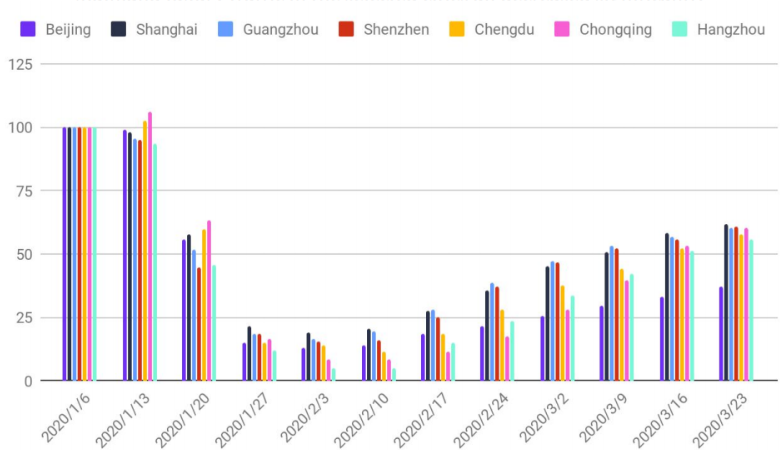

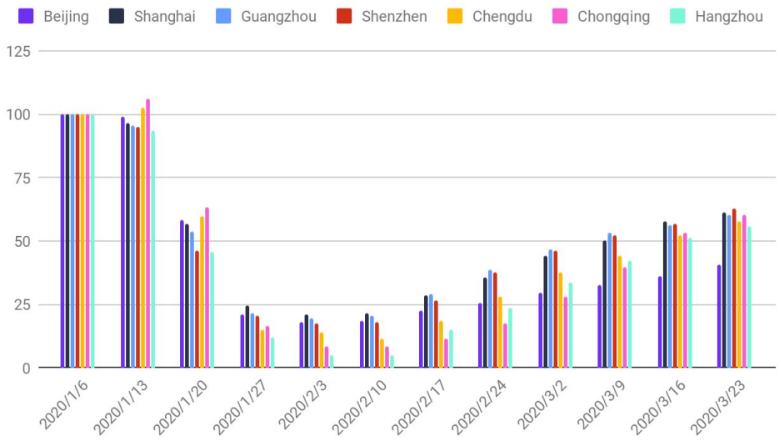

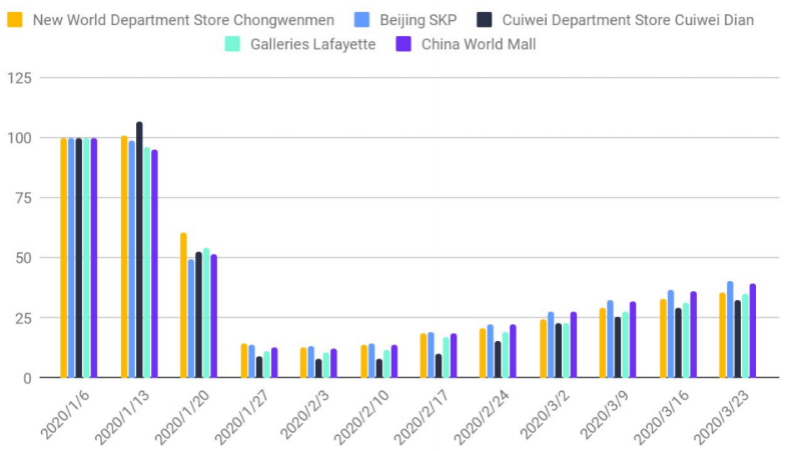

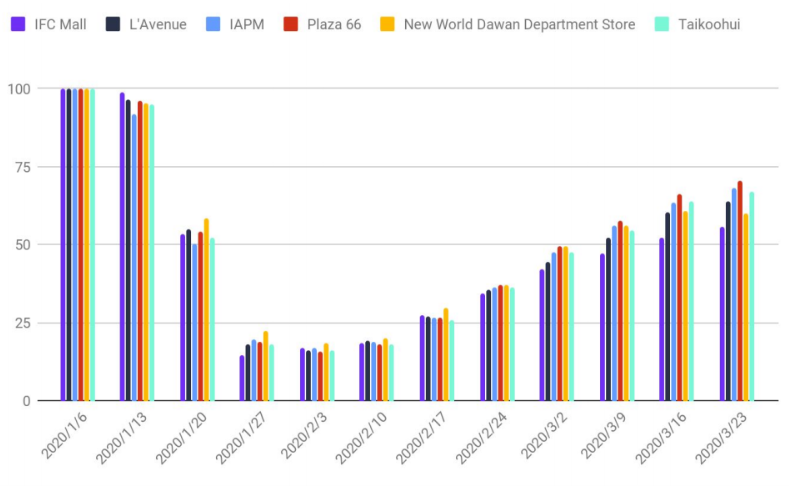

I am looking at footfall data from January to March 2020 provided by Cosmose.ai in their newest report. Cosmose studied four first-tier cities (Beijing, Shanghai, Guangzhou, and Shenzhen) and three new first-tier cities (Chengdu, Hangzhou, and Chongqing) in Mainland China, as well as Hong Kong and Macau from January 2020 to March 2020. Data was retrieved from close to a thousand shopping malls, hotels, luxury, cosmetic and beauty brands located in the mentioned cities.

SUMMARY

1. If the recovery trend continues at the current pace, offline retail should bounce back to the pre-pandemic level by June.

2. Beauty recovers faster than luxury. That said, it might not translate into a faster recovery of this sector in terms of transaction value due to a lower unit price

3. New first-tier cities show buying potential. They were more sensitive to the changes during the outbreak, but they recovered faster than old leading cities.

4. Duty-free retail is in a tough spot. The recovery of travel retails will be much slower than the domestic recovery as other countries struggle to contain the COVID-19 outbreak.

Traffic index is a concept Cosmose has used that aims to standardize the foot traffic captured from January to March 2020 to easily compare different cities and categories, and examine how the COVID-19 pandemic has impacted the businesses. The charts do not show actual visit numbers, but an index relative to the traffic on January 6, which is represented by “100” for all the cities, shopping malls, and stores.

Mainland China

The retail traffic downturn started in mid-January due to the migration of people from major cities back to their hometowns for the Chinese New Year and the growing awareness of the spread of COVID-19. The rebound of retail traffic started in mid-February. The growing traffic in shopping malls in Shanghai demonstrates faster recovery. Retail traffic from the beauty category recovered slightly faster than luxury. For both luxury and beauty, by the end of March, traffic was at 60% pre-pandemic for all selected cities except Beijing.

Hong Kong & Macau

The majority of Hong Kong retail traffic has been wiped out by the end of January due to restrictions of Mainland travelers as well as the awareness of the spread of COVID-19. The recovery was slower compared to Mainland China and the growth is visible in April only (this report focuses on January-March 2020). Macau hotels and malls have been hit the hardest by the pandemic and there are no signs of recovery yet.

RETAIL FOOTFALL INDEX MAINLAND CHINA LUXURY

- Mainland luxury traffic in the selected cities all decreased significantly over 75% from mid-Jan to mid-Feb.

- New first-tier cities experienced harsher hits than Beijing, Shanghai, Guangzhou, and Shenzhen, with an average 90% decrease from the normal traffic level.

- All cities started to rebound in mid-Feb. with new first-tier cities- Beijing, Shanghai, Guangzhou, and Shenzhen.

- The recovery in Beijing was much slower compared to all the other cities in China.

RETAIL FOOTFALL INDEX MAINLAND CHINA BEAUTY

- Mainland beauty traffic in the selected cities dropped significantly by over 75% from mid-Jan to mid-Feb.

- Beauty stores in Beijing, Shanghai, Guangzhou, and Shenzhen were recovering faster than luxury boutiques.

- Similar to the luxury category all cities started the recovery in mid-February, with Beijing showing the slowest increase in traffic.

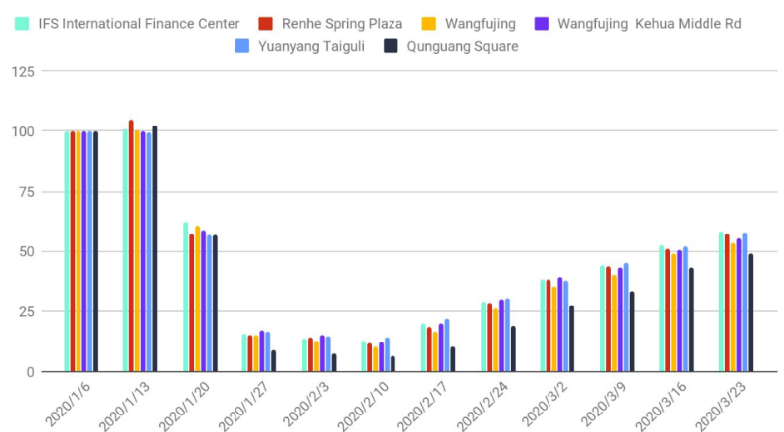

RETAIL FOOTFALL INDEX BEIJING PREMIUM MALLS

- Traffic in premium shopping malls in Beijing experienced a drastic decline by over 85% from mid-Jan to mid-Feb.

- Traffic started to pick up only from the third week of Feb. and by the end of March reached an average of 35% pre-pandemic traffic.

RETAIL FOOTFALL INDEX SHANGHAI PREMIUM MALLS

- Traffic in premium shopping malls in Shanghai dropped by over 80% from mid-Jan to mid-Feb.

- Traffic started to rebound from the third week of Feb, growing to the ~70% of the pre-pandemic level by the end of March.

RETAIL FOOTFALL INDEX CHENGDU PREMIUM MALLS

- Traffic for premium shopping malls in Chengdu declined by over 85% from mid-Jan to mid-Feb.

- Traffic started to recover from the third week of Feb. Chengdu malls were recovering faster than stores in Beijing, but ~20% slower than Shanghai.

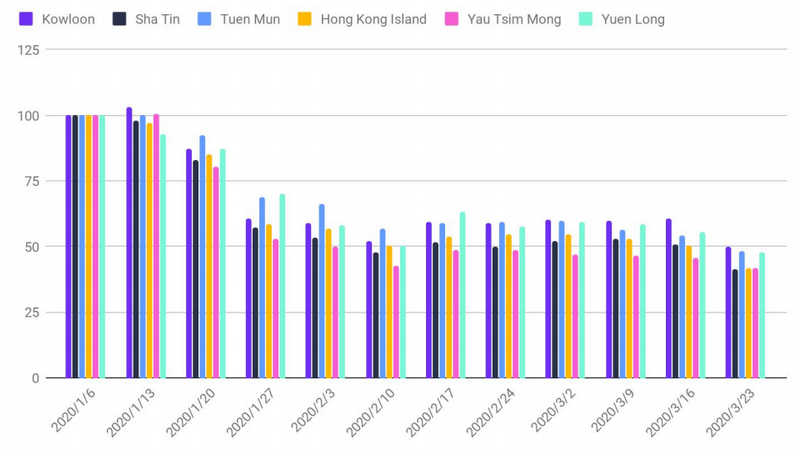

RETAIL FOOTFALL INDEX HONG KONG LUXURY

- Footfall in luxury brand stores in selected Hong Kong districts dropped ~40% pre-pandemic level by the end of Jan.

- Traffic has recovered modestly since then and started to deteriorate again from the end of March due to travel restrictions.

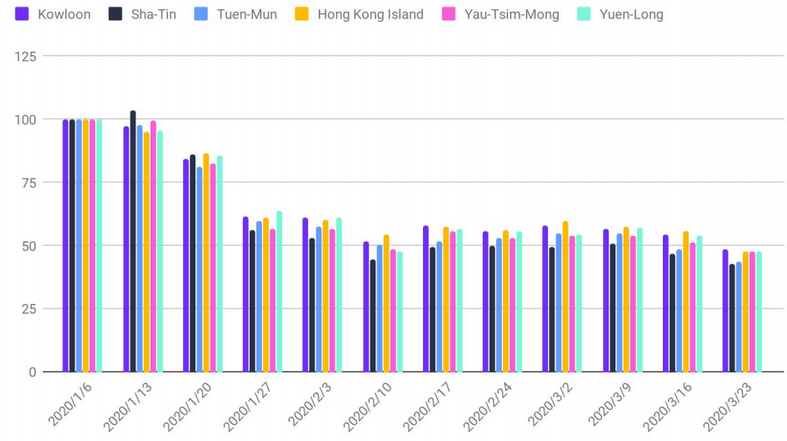

RETAIL FOOTFALL INDEX HONG KONG BEAUTY

- Traffic in cosmetics and beauty stores in Hong Kong was recovering slower than in luxury stores.

- Footfall remained almost stagnant since the beginning of Feb and declined by ~5% at the end of March.

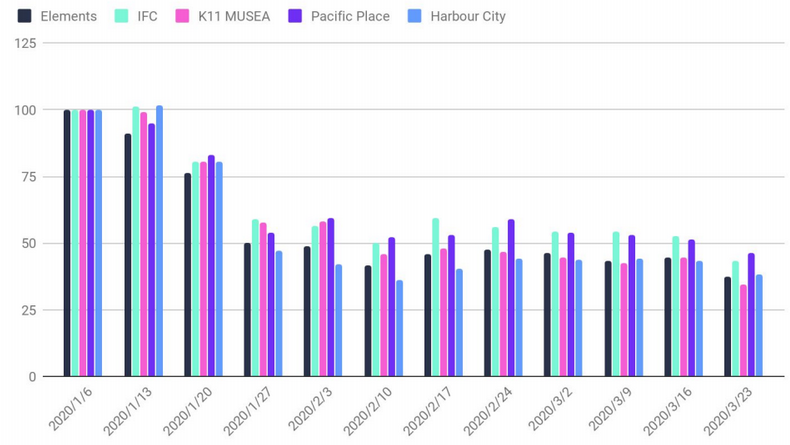

RETAIL FOOTFALL INDEX HONG KONG MALLS

- Footfall in selected premium shopping malls in Hong Kong have been halved by the end of Jan from its pre-pandemic level.

- Traffic in IFC and Pacific Place has been more resilient than other malls, but have also experienced a decline at the end of March.

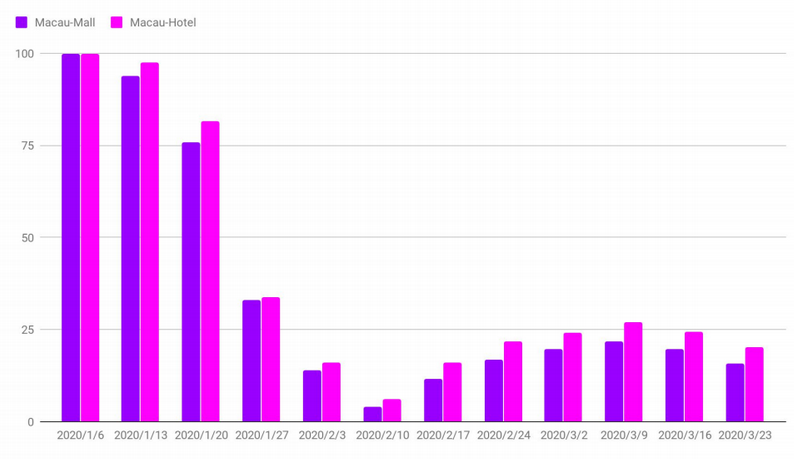

RETAIL FOOTFALL INDEX MACAU HOTELS & MALLS

- Footfall in brand stores at hotels and shopping malls have declined by ~95% by mid-February.

- The number of visitors started to increase in mid-February, declining again in the 2nd half of March.

Download the full report here.

Sign up to my newsletter (link) and get a free ebook “Chasing Black Unicorns. How building the Amazon of Africa put me on Interpol Most Wanted list.”